Despite an improving unemployment picture and resilient home prices, there are growing signs that the COVID-19 pandemic is finally catching up with the housing market, both in terms of sales and rents.

Residential Sales

According to Zillow’s May 2020 Real Estate Market Report, U.S. home values may decline in the second half of the year.

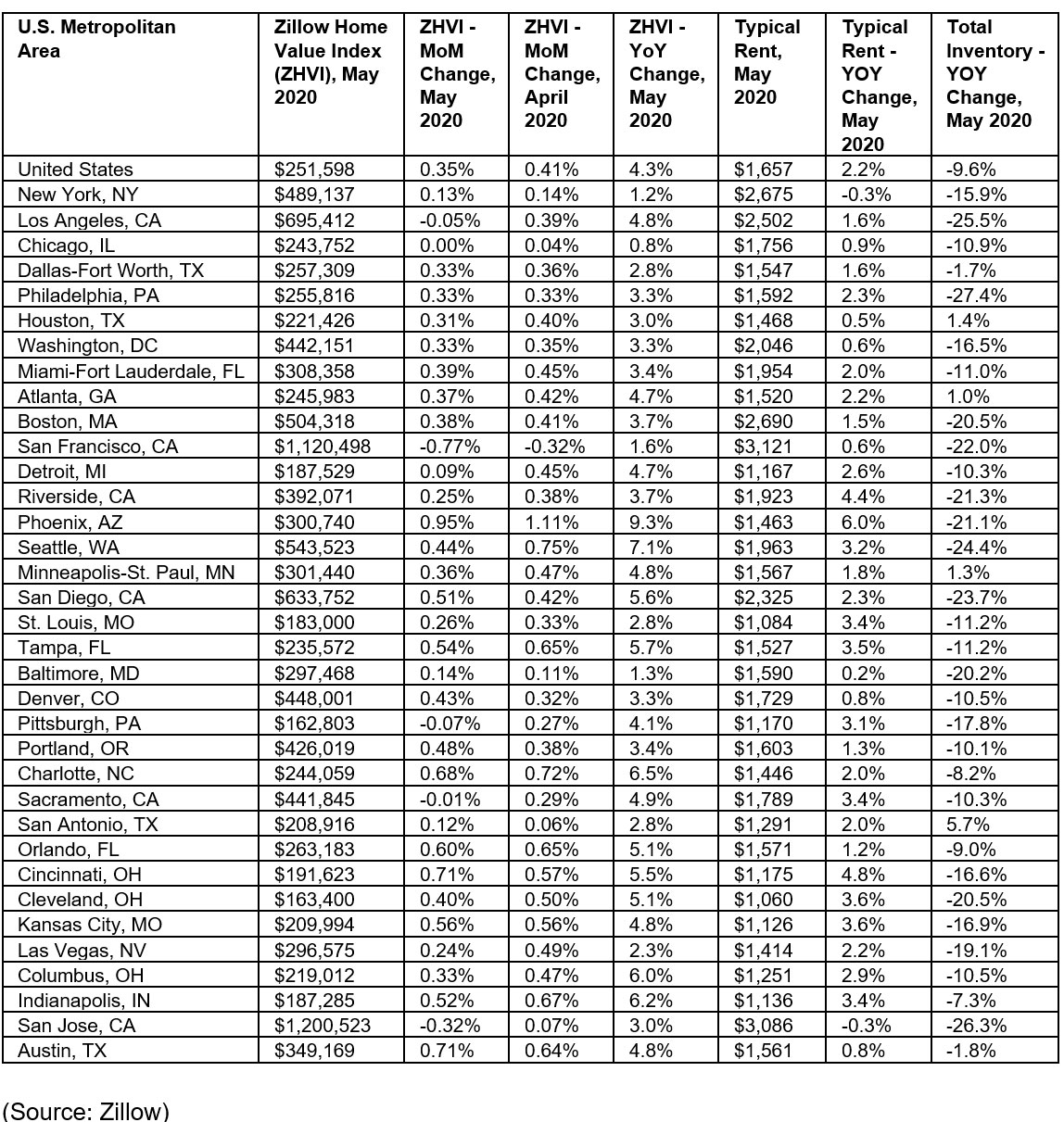

According to the Zillow Home Value Index, the typical home value in May slowed to 0.35%, the biggest one-month slowdown since March 2019 and a possible indicator that the market is headed for home value declines in the coming months. The most recent forecast from Zillow’s economic research team shows an expected 1.8% drop in prices through October 2020 from the highs in February, with a slow price recovery by mid-spring in 2021. The year-over-year change is forecasted to bottom out at -0.7%.

May’s home value growth slowdown was widespread, affecting 27 of the 35 largest U.S. metros. Home value growth slowed the most over April in a mix of the most expensive areas (San Francisco, San Jose, Los Angeles and Seattle), what had been the hottest markets (Phoenix, Columbus and Indianapolis) and metros in states with a high number of coronavirus cases (Detroit and Pittsburgh).

Home values fell from April to May in five metros — San Francisco, San Jose, Pittsburgh, Los Angeles and Sacramento.

“Home buyers returned to the market earlier than might have been expected given the state of the economy, finding a market starved for inventory because of seller uncertainty. This improved demand has supported home prices and appears to have given sellers a confidence boost as new listings have slowly picked up,” said Skylar Olsen, senior principal economist at Zillow. “The next question housing will face is whether this growth can continue after demand built up during housing’s brief pause in the pandemic’s early days runs its course. It’s likely housing will feel the broader economy’s downturn eventually, though to a mild degree, and home values will fall in the coming months.”

Rents are Crashing

Zillow also said that annual rent growth slowed for the third consecutive month, up 2.2% year over year to $1,657, the lowest rate of year-over-year growth since at least 2014. The annual growth rate slowed from the previous month in 27 large metros, and rents fell from last May in New York and San Jose.

In San Francisco, rents are down 9.2 percent year-over-year, according to the a report by Zumper, a national apartment search firm. Average apartment rents dropped to their lowest since at least 2015 — the median rent on a one-bedroom apartment was $3,360 in May, a roughly $300 decline year-over-year. Vacancy hit 6.2 percent in May up from 3.9 percent in March when residents were ordered to stay home to mitigate the spread of coronavirus.

In Mountain View, where Google is headquartered, rents fell 15.9% year over year, while in Apple’s hometown of Cupertino rents dipped 14.3%, according to the rental search engine Zumper. In San Bruno, where YouTube has its offices, rents tumbled 14.9%.

“It’s a dramatic drop in San Francisco and the South Bay,” said Zumper CEO Anthemos Georgides.

Meanwhile, in 30 South Florida cities, the rent for 62% of one-bedroom units are either flat or declining, reported the Sun Sentinel. The percentage increases to 69% for two-bedroom prices.

And CNN is reporting that in Manhattan, the median rent for a luxury apartment in May was $7,825 a month, a 10% drop from April, according to a report from brokerage firm Douglas Elliman and appraiser Miller Samuel. The median rent for all Manhattan apartments in May was $3,546, down 3% from April.