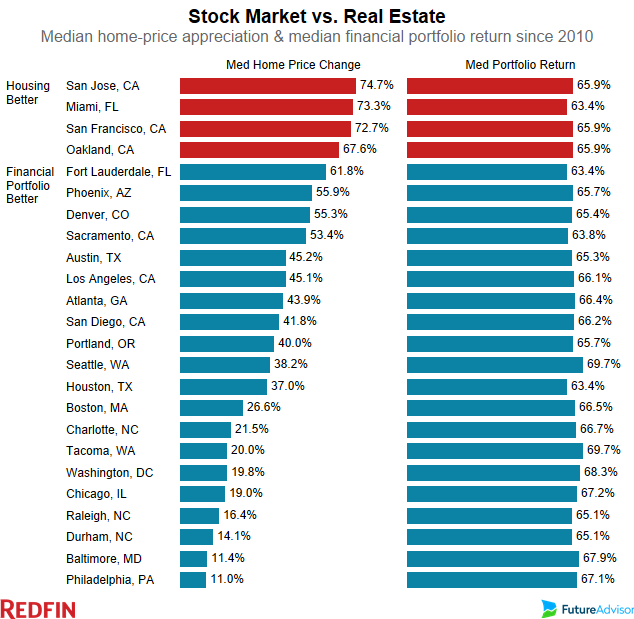

National realtor firm Redfin and investment advisory firm FutureAdvisor conducted a joint analysis on the performance of the stock market vs. the real estate market since the end of the financial crisis in January 2010 through May 2016. In doing so, the two firms analyzed the performance of a median financial portfolio vs. the median change in home values in 24 metro areas. Predictably, results varied by geographic location. Below are some of the findings:

- The median financial portfolio earned between 63-70% since January 2010, beating home price appreciation in 20 out of the 24 metro areas.

- The four-metro areas where home values beat the performance of the median financial portfolio were San Jose, CA at 74.7%, Miami, FL, 73.3%, San Francisco, CA, 72.7% and Oakland, CA, 67.6%.

- Interestingly, in most cities multi-family buildings, condos and co-ops had higher appreciation than single-family homes.