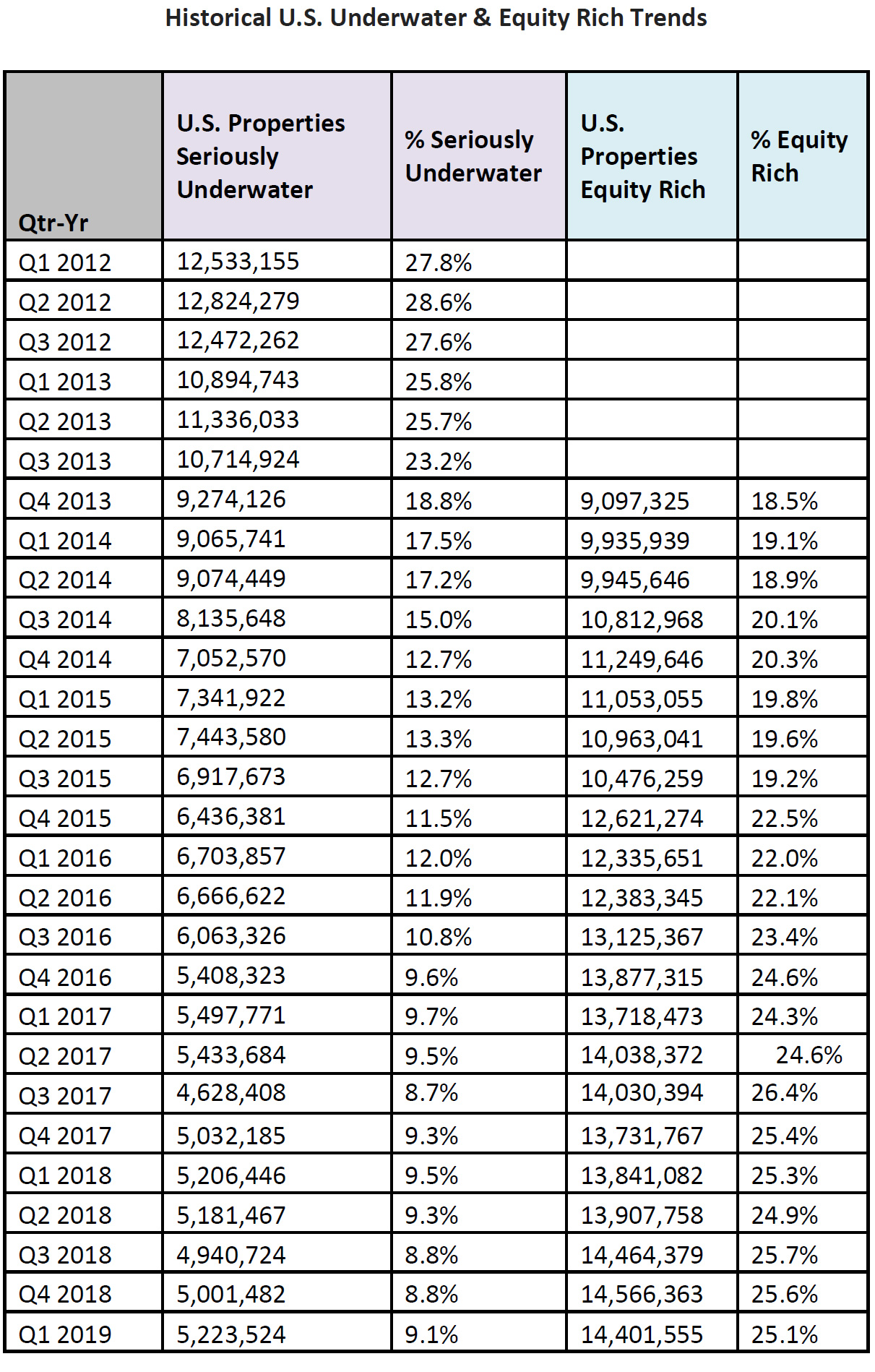

Based on ATTOM Data Solutions’ Q1 2019 U.S. Home Equity & Underwater Report, at the end of the first quarter of 2019, more than 5.2 million (5,223,524) U.S. properties were seriously underwater (where the combined balance of loans secured by the property was at least 25 percent higher than the property’s estimated market value), up by more than 17,000 properties from a year ago.

The 5.2 million seriously underwater properties at the end of Q1 2019 represented 9.1 percent of all U.S. properties with a mortgage, up from 8.8 percent in the previous quarter but down from 9.5 percent in Q1 2018.

“With home prices increasing at a slower pace in 2018, than in previous years, the potential for people to climb out from mortgages that are underwater or advance into equity-rich territory, tends to be reduced,” said Todd Teta, chief product officer at ATTOM Data Solutions. “However, only one in 11 mortgages are seriously underwater today, compared to nearly one in three during the depths of the recession. Although, if the latest trend continues, it will raise another clear signal of a market slowdown, which will be good for buyers, but not so good for sellers. But if the pattern of the past few years takes hold – with levels of underwater and equity rich mortgages turning around – it will mean the market remains strong for sellers, with fewer needing to get out from under financial distress.”