Nearly a quarter of all home sales in the U.S. were paid for outright, according to a report by Redfin. About 24.3 percent of homes sold so far this year were bought with cash, down from 25.3 percent in 2019 and the smallest share since 2007. All-cash home purchases peaked in 2013, when 34 percent of homes sold were bought with cash. The share has generally declined since then.

Because of the pandemic-driven recession, mortgage rates are at record lows this year, dropping as low as an average of 2.71 percent.

“With interest payments lower than ever before, many homebuyers would prefer taking out a home loan and putting their cash somewhere else, like the stock market, emergency savings accounts or home renovations,” said Redfin chief economist Daryl Fairweather. “Many of the buyers who are using all cash this year are probably trying to beat out other offers in a situation with multiple offers.”

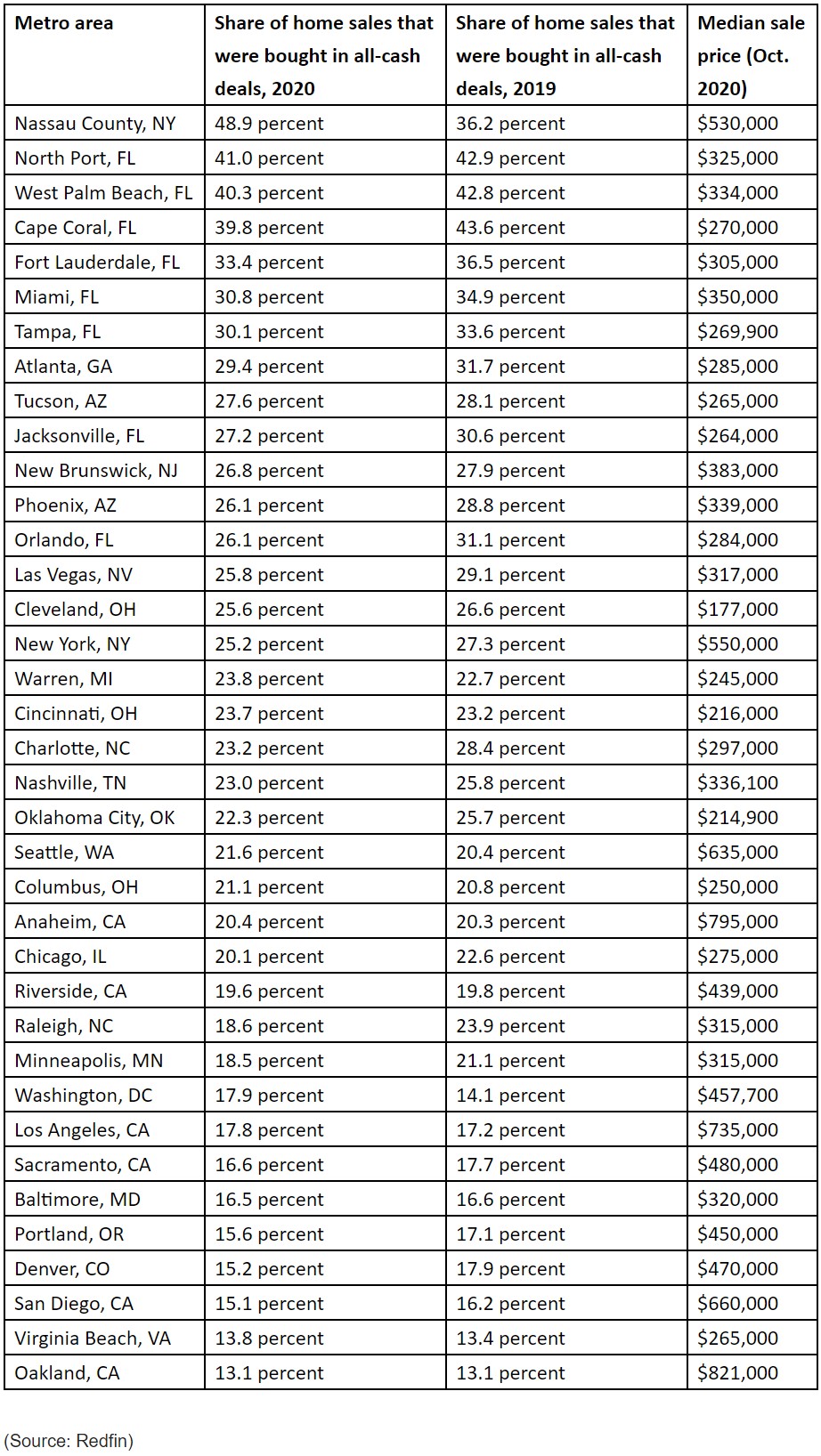

In Nassau County on Long Island, 48.9 percent of homes sold this year were all-cash purchases, a higher share than any other major metro area.

Nassau County is followed by six Florida metros: North Port (41 percent), West Palm Beach (40.3 percent), Cape Coral (39.8 percent), Fort Lauderdale (33.4 percent), Miami (30.8 percent) and Tampa (30.1 percent).