Latin homeownership gains in recent years have far exceeded those of other groups. About 18% of the U.S. population identifies as Latin, yet they have accounted for more than 60% of new U.S. homeowner gains over the past decade, according to a new report by Zillow.

However, while the 1.7 percentage-point gain among homeowners matches closely with the 2.1-point gain in overall population share, homeownership among Latin Americans still hasn’t reached parity with those that do not identify as Latin. Whites make up 68% of U.S. household decision makers, but represent 76% of all U.S. homeowners.

Despite recent gains, the Latin homeownership rate continues to lag more than 10 percentage points behind the rate for Asian, Native, Hawaiian and Pacific Islander households, and nearly 25 percentage points behind non-Latin white households. A disparity in household wealth is likely a major contributor. The typical Latin household earns about 75% of the typical white household as of 2018, but that typical white household held more than eight times the amount of overall wealth. That means Latin households carry a far greater share of their wealth in their homes, adding to the pain caused by the Great Recession.

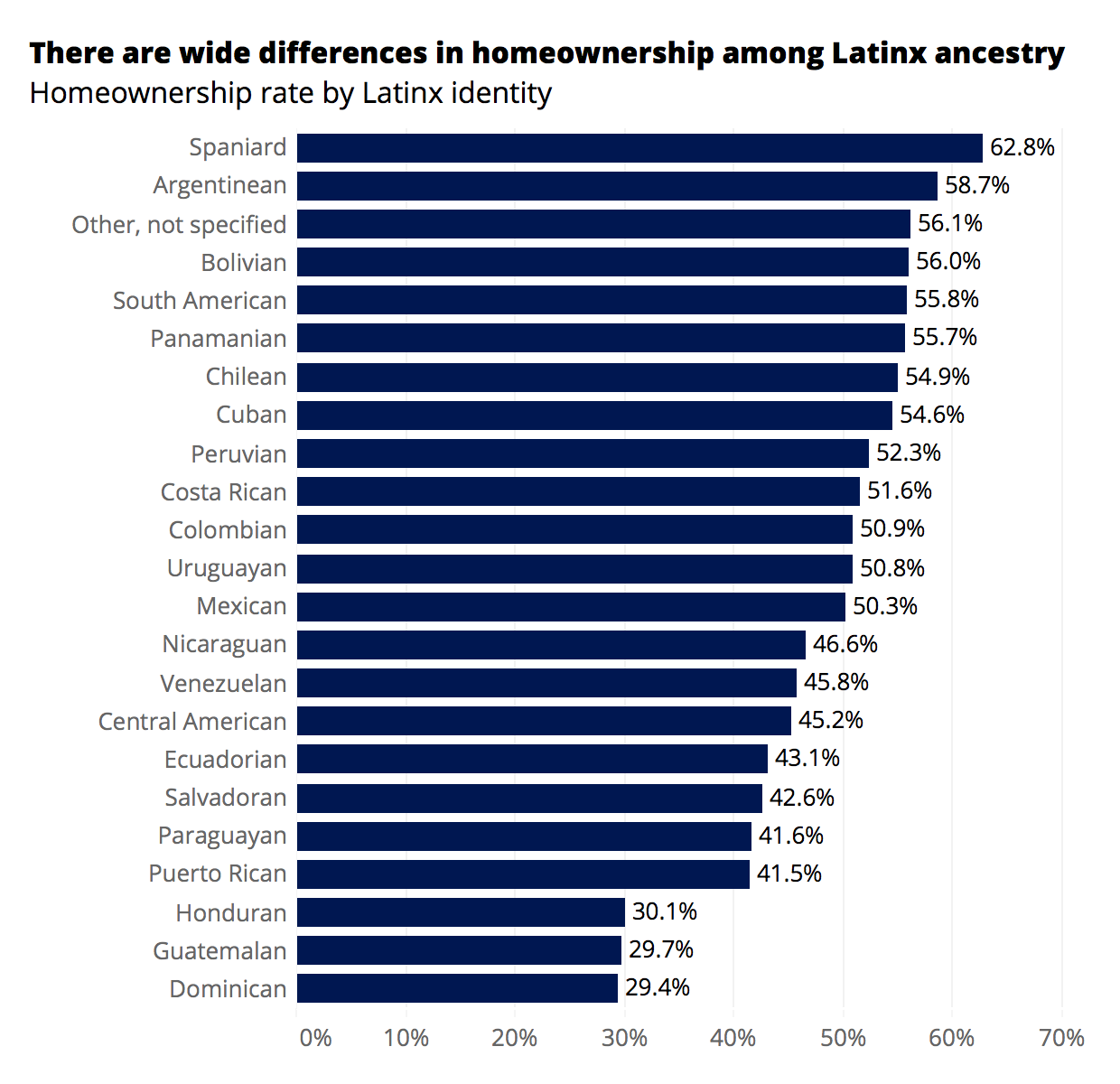

Those who more recently moved to the U.S. are less likely to own a home — perhaps explaining why the homeownership rate among first-generation Latin Americans (46%) is lower than among other generations (50%) — as are those coming from less wealthy backgrounds. Latin Americans of Spanish descent have the highest homeownership rate at 63%, while households headed by someone of Dominican descent have the lowest at 29%.

Latin buyers overall are more likely to be first-time home buyers — 56% report buying their first home, compared to 43% of buyers overall. First-time buyers face greater financial hurdles because they don’t have access to equity from a previous home purchase to help with a down payment and almost always (80% of the time) finance their purchase with a mortgage. Latin buyers are denied by mortgage lenders at a higher-than-average rate and 65% say they are concerned about qualifying for a mortgage at all.

To reach homeownership, Latin buyers more often put other life milestones on hold because of the financial burden. More Latin buyers than average report that the cost of housing delayed marriage plans (28% said so, versus 18% of all buyers), having children (29% versus 19%) and retiring (26% versus 19%).

Latin Americans are a massive and diverse group numbering more than 60 million. Between 2014 and 2018, Latin Americans identified with more than 200 unique ancestries and spoke more than 100 distinct languages at home. That diversity is also evident in the often wide differences in homeownership within the community overall. For example, just 29% of Latin household decision makers of Dominican descent own their home, compared to 63% of those reporting Spanish descent.