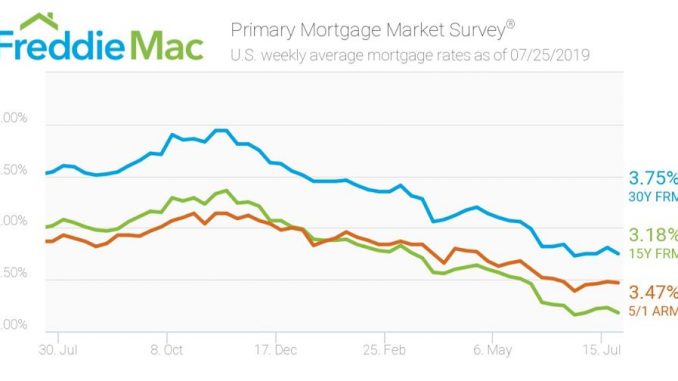

According to the FreddieMac Primary Mortgage Market Survey, U.S. mortgage rates fell towards three-year lows as markets anticipate an interest rate cut from the Federal Reserve Bank during its meeting next week.

Many observers are hopeful that lower rates will further invigorate different sectors of the economy, including the slowing real estate market.

- 30-Year Fixed Mortgage (FRM): Averaged 3.75 percent, down from last week when it averaged 3.81 percent. A year ago at this time, the 30-year FRM averaged 4.54 percent.

- 15-Year Fixed Mortgage: Averaged 3.18 percent, down from last week when it averaged 3.23 percent. A year ago at this time, the 15-year FRM averaged 4.02 percent.

- 5-Year Adjustable-Rate Mortgage (ARM): Averaged 3.47 percent, slightly down from last week when it averaged 3.48 percent. A year ago at this time, the 5-year ARM averaged 3.87 percent.