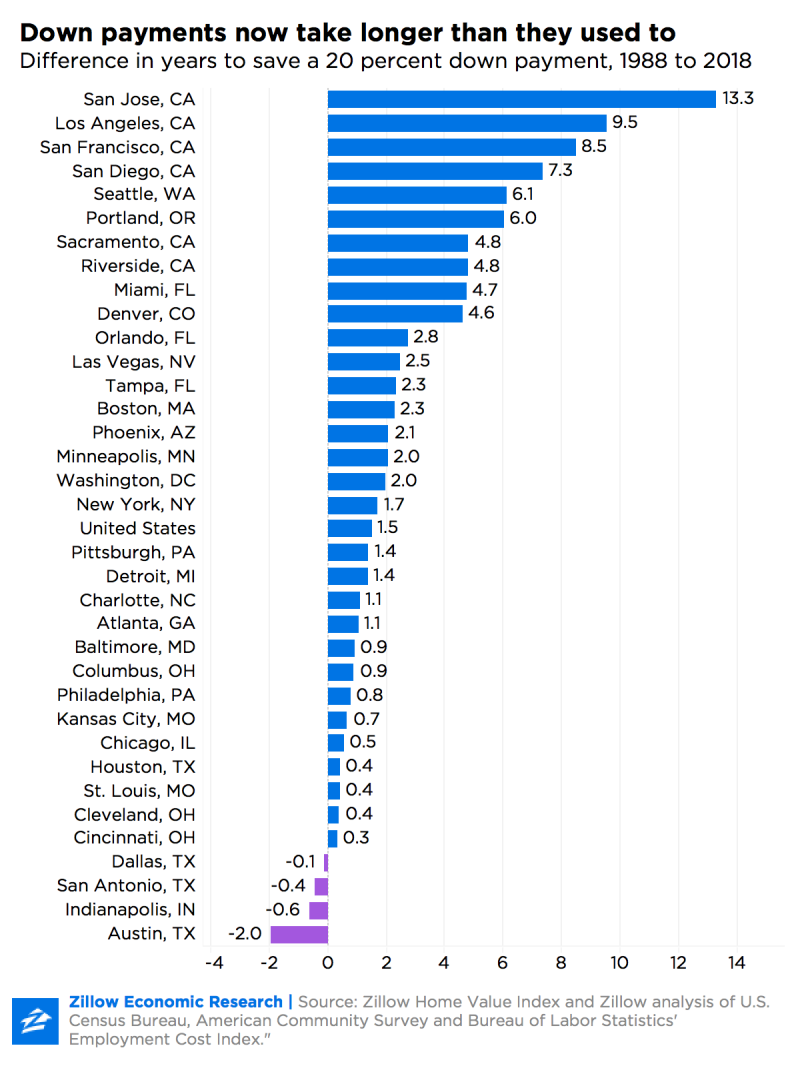

Using the national median incomes and home values of today, buyers these days need an extra year and a half, for 7.2 years total, to save a 20 percent down payment on the median valued home. Despite the booming job markets of the past decade, buyers saving down payments now – mostly first-time buyers, 61 percent of whom are millennials, according to the Zillow Group Consumer Housing Trends Report 2018 – need even more time to accomplish what previous generations did. First-time buyers say that 46 percent of their down payments come from savings, compared with 35 percent for repeat buyers, the report found.

In San Jose, Calif., buyers would need a whopping additional 13.3 years. Los Angeles, San Francisco, and San Diego are not much friendlier, requiring an additional 9.5, 8.5, and 7.3 years, respectively, compared to three decades ago. It’s not just California, however: Down payments in the Pacific Northwest are similarly out of reach, requiring an extra 6 years for millennials compared with buyers 30 years ago in both Seattle and Portland.

In a handful of major metropolitan areas, the time it would take to save a down payment with a constant savings rate of 10 percent is actually shorter than it was 30 years ago; these are areas where the much-maligned millennial generation is better able to get this stuff together. These metros include Austin, Texas (almost 2 years shorter), Indianapolis, (almost 8 months shorter), San Antonio (5 months shorter), and Dallas-Fort Worth (less than two months shorter).