The U.S. fell 7.3 million units short of meeting housing demand between 2000 to 2015, according to new research from the Up for Growth National Coalition, ECONorthwest, and Holland Government Affairs.

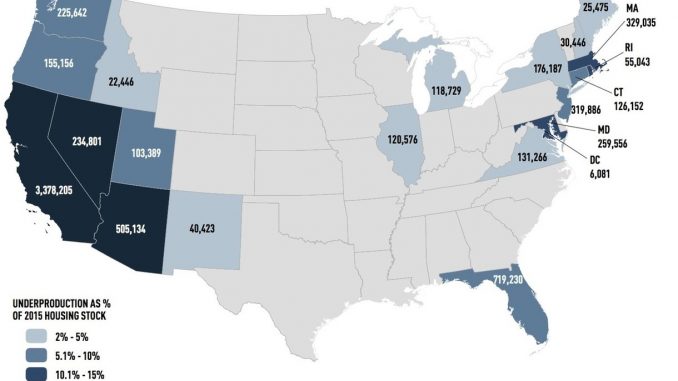

The Housing Underproduction in the U.S. report details the depth and breadth of the housing crisis by focusing on the 22 states and Washington, DC that failed to meet their historic housing production demand.

While California accounts for over 45% of the total shortage at nearly 3.4 million units, states in nearly every corner of the country under produced housing, representing over 5% of total housing stock. In addition to increasing rents and home prices at an unsustainable level, failure to meet housing demand has other negative societal impacts, including suppressing national GDP, generating negative environmental impacts, and pushing individuals and families with limited incomes farther away from job centers.

The report goes beyond simply identifying the depth of the housing shortage. It examines three different approaches to meeting demand: more of the same, intensifying urban density, and smart growth. More of the same assigns new housing based on existing patters that favor low-density, suburban sprawl. Intensifying urban density assigns additional housing units through a top down approach, filling in the densest existing block groups first to provide a comparative, if infeasible, baseline representing the extreme end of dense development. Smart growth would favor new housing based on a formula of existing density, distance to transit stops, and the share of commuters in a given area who drive their own vehicles to work.

The research suggests the significant benefits in the smart growth scenario. For example:

- Using only 25% of the land required under the more of the same approach, smart growth could produce 7.3 million units by producing 10% single family homes, 61% in middle density housing such as townhomes, cottage clusters, and mid-rise buildings, and 29% in towers. More of the same would mean 54% of new units would be single-family homes alone, which require much more land and infrastructure installation and are often out-of-step with the lifestyle choices of younger Americans.

- Because housing is distributed more densely and closer to transit stations, smart growth could reduce vehicle miles traveled by 28%, if patterns produced in California hold for other under producing states. Taking cars off the road improves quality of life and cuts CO2 emissions.

- Based on a dynamic, 20-year economic model, the report estimated that growth in a smart-growth approach would create an additional $400 billion in GDP relative to more of the same, or $2.1 trillion in cumulative GDP over the baseline forecast.

- The report estimates that smart growth would generate an additional $128 billion in federal income and payroll taxes over the same 20-year period. Local tax revenue, particularly property taxes, would also increase under smart growth.

“This new report makes a strong analytic case for policies that would enable a greater volume of higher density, transit-oriented development,” said Harvard’s Joint Center for Housing Studies’ Managing Director Dr. Chris Herbert. “The findings offer compelling evidence that such policies would reduce infrastructure costs and vehicle miles traveled and expand the supply of housing, helping to alleviate upward pressure on rents and home values. Importantly, the report’s recommendations also point to the need to capture a portion of the value created by allowing higher density development to provide financial support for a much-needed expansion of the supply of affordable housing.”